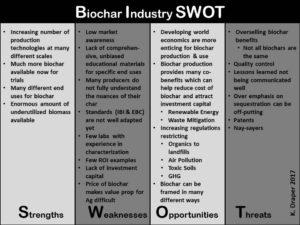

Increasingly I am fielding calls from larger and larger companies expressing interest in diving into the biochar world. What they all want to know ‘Is this the right time?’, which prompted me to put together my perspective of the biochar industry’s current SWOT. This is based on frequent discussions with other biochar consultants, current producers, technology vendors, researchers and potential investors. It’s not meant to be exhaustive by any stretch, but rather it can serve as a high level view of those factors pushing and preventing the industry from growing. [Note: this is predominantly a US view, but is probably not too far off for other parts of the developing world.]

Although this chart makes it seem like the weaknesses outweigh the strengths, that is not how I see the current landscape. The most interesting thing to observe these days is that there are certain policy initiatives, albeit mostly at the state level (or regional in the EC), that may be driving carbonization of biomass faster than the oft-dreamed of holy grail of biochar acceptance on the carbon markets might have. Though many folks were, and in some cases still are, convinced that until or unless biochar becomes an accepted offset product, the industry would languish, I don’t subscribe to that particular philosophy. The carbon markets are still not all that huge, [though they are growing in some cases e.g. RGGI and CA], and the price of offset products is still rather pitiful (e.g. <$15/ton CO2e in CA and way less under RGGI). The reality is, for better or for worse, that biochar is still not an accepted offset (or better yet sequestration) product on any mandatory exchange. And yet the biochar market seems to be growing at a nice clip, though it is very hard to get solid numbers.

What could be better than carbon markets you ask? Bans! Barring organic waste from landfills may soon become a boon for the biochar production. As landfills fill up, and NIMBY prevents new landfills from opening States are looking to restrict what gets sent to their existing landfills in an effort to extend their life expectancy. NY is considering joining a growing number of other states that have at least some type of requirements for organic waste diversion. Diversion options can be expensive depending on how far away a waste generator is to a food pantry, livestock farm, composting, AD or other facility which will accept them. Certain types of organics (e.g. sewage sludge, yard waste) do not lend themselves to too many current diversion options. In these scenarios pyrolysis (or gasification) is a scalable solution offering a variety of co-products (e.g. heat, electricity, biochar) which can offer an attractive option to increased tipping fees.

At some level this restriction of organics to landfills is in its own way an easier to administer carbon tax. By eliminating the ability to choose what has traditionally been the lowest cost but highest emitting disposal option, it incentivizes waste producers to find alternative waste management processes which will also (likely) reduce their carbon footprint, at least the portion related to CH4 emissions from organics in landfills + transportation of waste. Done right the waste generators could also use the heat (or electricity) produced during carbonization, thereby reducing their reliance on fossil fuel energy. In many cases, they might also be able use or sell the resulting biochar to further improve waste management economics. A few examples might help elucidate this thinking: 1) coffee roaster: instead of landfilling the chaff, they can carbonize it and use the heat for the roasting process; 2) tofu manufacturer: instead of landfilling the wet okara byproduct they can carbonize it and use the heat to dry the okara then use the biochar to filter the whey effluent; 3) wastewater treatment facility: carbonize sludge or digested sludge and use biochar to filter effluent. There are many such examples that could work, though those generators with a more homogeneous waste stream have a huge advantage over those that have a very heterogeneous one (e.g. supermarkets, etc.) since that kind of biomass doesn’t make for high quality, consistent biochar and can run havoc on production equipment.

For more info on the current state of the biochar industry, you may want to listen to a recording of Webinar from earlier this week on the Past, Present & Future of IBI and the Biochar Industry given by myself and Tom Miles, the Chair of IBI’s Board of Directors.